If you’ve been following the Helium Network’s development, you may already be familiar with the concept of Helium halving. It’s the process by which the amount of Helium mined by the network in a period of time is halved, so as to avoid inflation of the native token.

That sounds like a daunting concept to Helium miners, especially those who want to get started now. If only half the Helium is being mined, will it even be profitable for me to get started now? We think the answer is a resounding yes. And we’re here to explain to you why there’s never been a better time to get started.

In today’s blog we will:

- Introduce the concept of Helium Halving

- Explain why Helium is still a great investment

- Introduce the Emrit Model – cost and profit-sharing can get you mining Helium at a lower cost to yourself

Helium Halving: The What and Why

Helium is built to provide network coverage to IoT systems around the world in a blockchain-secured manner. Helium’s native token, HNT, is issued to reward network participants. In other words, it can be mined by hosting a helium hotspot. Network users (the companies and individuals that use the network’s connectivity) pay the network for use in HNT. That is roughly how the financial ecosystem of Helium works.

Helium is built to provide network coverage to IoT systems around the world in a blockchain-secured manner. Helium’s native token, HNT, is issued to reward network participants. In other words, it can be mined by hosting a helium hotspot. Network users (the companies and individuals that use the network’s connectivity) pay the network for use in HNT. That is roughly how the financial ecosystem of Helium works.

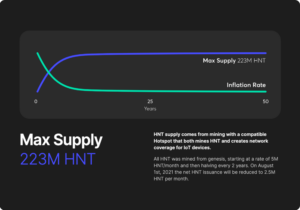

Think of mined HNT as being freshly minted. It’s not merely recycled from network users spending data credits but newly created by activity from Helium hotspots. Every two years, the Helium network halves the amount of HNT that can be mined globally in a month. Why does the network do this? To control the money supply of its native financial ecosystem.

When a new network is launched, it needs to create a money supply of data credits – but financial growth and money supply do not remain directly related: to create data credits beyond the needs of the network, would be to inflate the HNT supply, and make the financial ecosystem less efficient.

The first halving took place on August 1st, 2021. Before that date, 5 million HNT were mined every month. Since the halving, the net HNT issuance has been decreased to 2.5 million per month.

That can seem like a daunting concept to someone just learning about Helium mining: why get in now, if I can only get half the amount of Helium I could before? That’s a good question, but not one you need to worry about. Helium is designed to grow. And each fraction of HNT you mine will become increasingly profitable over time.

The Financial Promise of Helium

Since the beginning of 2021, HNT has already gained around 4000% in value on exchange networks. At the beginning of the year, one HNT was valued at around $1.30. Now, in February, its value has reached around $30. The market cap of Helium has expanded to over $3 billion dollars.

Since the beginning of 2021, HNT has already gained around 4000% in value on exchange networks. At the beginning of the year, one HNT was valued at around $1.30. Now, in February, its value has reached around $30. The market cap of Helium has expanded to over $3 billion dollars.

That’s the kind of indicator that gets investors interested. What can we infer from past performance? Has there been growth, and is the potential of growth high? What kind of financial promise does a network yield at all? And how do we know that Helium will continue increasing in value?

Take a cell carrier like Verizon. Verizon has a market cap of over $220 billion. Of course, Verizon is a household name in the US, with significant cell infrastructure in every state. But even a regional carrier like Spectrum has a market cap of $115 billion.

Unlike both Spectrum and Verizon, Helium is a global network. Its growth potential is incredibly high; if it’s already got a market cap of $3 billion now, in the early stages of its infrastructure rollout, just wait until Helium continues expanding. In fact, Helium is already preparing to build on its IoT coverage and launch an additional decentralized 5G network in the near future.

That means global, decentralized cell coverage for human users. Sounds promising? It does to us, too. And that’s why helium halving isn’t half as scary as it sounds – though it impacts helium mining by yielding a lower network reward, the sheer act of mining is contributing to making that earned HNT more profitable. Exponentially so, in the long run.

The Emrit Model

The real downside to getting into Helium mining is not Helium halving – it’s the cost of a miner. These devices can cost $600 dollars. That’s a big investment – and you likely won’t see the financial returns in HNT accumulate to that amount for a long while.

The real downside to getting into Helium mining is not Helium halving – it’s the cost of a miner. These devices can cost $600 dollars. That’s a big investment – and you likely won’t see the financial returns in HNT accumulate to that amount for a long while.

That’s where Emrit comes in.

Emrit is a distributed blockchain infrastructure company, dedicated to deploying the physical infrastructure needed to expand a blockchain network at the edge of the network. We employ a profit-sharing model. We subsidize over half the cost of a miner and send it to you. In return for hosting it, we split the earnings of your miner 50/50.

Our first major project is the expansion of the Helium network – Emrit has already become a leading Helium miner in the world, significantly supporting the expansion of the network.

It’s the best way to start mining in your home or place of work – with Emrit, some of the financial burden is off of you – but you’ll still be earning crypto at a steady rate. Start now, before HNT’s next big boom.

By joining Emrit, you’ll also be joining a worldwide community of dedicated Emritans. We’re here to help each other make smart investments, maximize our mutual profits, and build the next generation of digital infrastructure.

Sounds like a smart investment? We think it is. Helium is the future – and it’s only the beginning.

Summary: HNT Halving? Not to Worry

If you’ve been scared off Helium mining by daunting terms and ill-explained concepts, we’re here to tell you to stop being scared. We think Helium mining is going to become more and more profitable, in spite of the first halving of last August. And it’s bound to become exponentially more as Helium IoT scales and launches its 5G project.

If you are put off by the cost of a Helium miner, why not join Emrit, and pay less to get into this smart long-term investment now?

In today’s blog we:

- Introduced the concept of Helium Halving (and told you not to worry about it)

- Explained the Promise of Helium’s Financial Growth

- Explored why the Emrit Model of Profit-Sharing can be the best and most approachable way to get into Helium mining

No matter which way you slice it – Helium mining is emblematic of the future of the web. It’s both a promising financial investment and actively supports building the next generation of digital infrastructure.

Helium is just the beginning – by working with other companies we aim to build the blockchain networks that change the world. Learn about our upcoming work with PlanetWatch, which aims to measure net emissions with greater efficiency.

Join Emrit today and follow our blog, Discord, and social media to stay up to date on the most exciting developments heading your way. Become part of the future of the web today!